The data for The 2023 Kerrigan Dealer Survey is based on over 650 responses from franchised auto dealers in Kerrigan Advisors’ proprietary dealer database. Survey responses were collected from June 2023 to October 2023.

2023 Kerrigan Dealer Survey Results

Kerrigan Advisors’ fifth annual Dealer Survey was designed to gauge dealer sentiment on the future value of their business, growth plans, earnings expectations, as well as perspectives on franchise values and their trust levels in the OEMs.

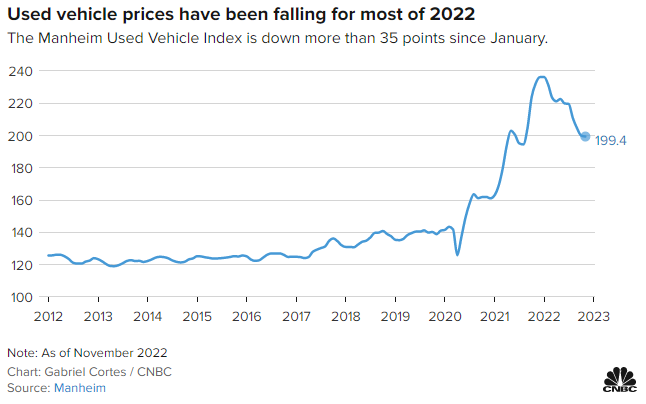

The results of this year’s survey found a majority of dealers still have a positive outlook on valuation over the next 12 months with 52% projecting 2023’s strong valuations will sustain into 2024 and 21% expecting an increase next year. That said, more than a quarter of dealers (27%) expect valuations to decrease in the next 12 months, the highest level since the survey’s inception in 2019, and almost double 2019 and 2020’s levels.

The reduction in valuation expectations is consistent with dealers’ views on future profitability (see chart on following page). Only 15% of surveyed dealers project a rise in profits in the next 12 months, while 38% expect a decline. Interestingly, 47% project earnings will stay the same in 2024, a six-percentage point increase from last year and an indication that current earnings, which remain far above pre-pandemic levels, are starting to normalize according to more dealers.

With a rising number of dealers seeing a decline in earnings in the next 12 months, it is not surprising to see an increase in dealers seeking a sale, albeit still a slim minority. 6% of dealers surveyed plan to sell one or more dealerships in the next 12 months, three times 2022’s results. That said, nearly half of dealers still plan to grow their enterprise with 47% looking to add one or more dealerships.

Kerrigan Advisors attributes this growth bias to dealers’ significant capital accounts as a result of more than three years of record profits. Kerrigan Advisors estimates the industry has amassed over $200 billion in pre-tax profits since 2020. In addition to burgeoning capital accounts, the majority of dealers (62%) believe earnings will either stay at 2023’s high level or increase over the next twelve months. This indicates that most dealers do not believe earnings will revert to pre-Covid levels in the near future, if ever, which bodes well for the continuation of a growth bias amongst dealers.

2023 Kerrigan Dealer Survey Results by Franchise

Note: These results reflect the collective view of the 650+ dealers surveyed, regardless of a dealer’s specific franchise ownership.

While the majority of dealers surveyed believe individual franchises will either increase or remain the same in value over the next 12 months, every franchise saw a reduction in the percentage of dealers projecting an increase in value along with a rise in the percentage of dealers expecting a decline in value as compared to 2022. Kerrigan Advisors believes these results are a reflection of the rising discontent within the dealer body regarding OEMs’ electric vehicle (“EV”) strategies and the overabundance of EVs on many dealers’ lots.

Highest Expected Valuation Gains:Kia, Hyundai, Lexus, Toyota, Porsche

- Over 30% of surveyed dealers expect these five franchises to increase in value in the next 12 months.

- This marks the second year Kia and Hyundai topped this list and exceeded Toyota.

- Notably, Kia’s results are nearly two and a half times higher than the industry average.

Least Likely to Decline in Value: Lexus, Toyota, Porsche, BMW

- 90% or more of surveyed dealers expect these four franchises to either increase or remain the same in value in the next 12 months.

- Of note, this is the same list as last year.

Highest Expected Valuation Declines: Lincoln, Infiniti, CDJR, Ford, Buick GMC, Nissan

- Over 40% of surveyed dealers expect these franchises to decline in value in the next 12 months.

- Notably, Lincoln and Infiniti’s results are more than double the industry average.

Kerrigan Advisors queried dealers again regarding the expected impact of OEM planned changes to the dealer model on future profitability. The majority of dealers are less concerned than they were in 2022 that OEM changes to retailing will impact their future profitability. Nearly every franchise saw a notable rise in the percentage of dealers who expect no impact on profitability from OEM retailing changes. Kerrigan Advisors believes this marked improvement from the 2022 Dealer Survey is a result of dealers’ skepticism regarding OEMs’ ability to execute on their proposed retailing changes, particularly given weak consumer demand for EVs.

For the first time since Kerrigan Advisors started querying dealers, our firm asked about dealers’ trust level in each franchise. The results were quite noteworthy and echoed the sentiment regarding changes to OEM retailing strategies. Toyota received the top results by far, with 72% of dealers indicating they had a high level of trust in the franchise, over three times higher than the survey average. By contrast, 46% of dealers reported they had no trust in Ford, consistent with the expectation of a decline in future Ford franchise profitability due to the OEM’s EV/future retailing strategy.

Notable Changes for Specific Franchises (2023 versus 2022)

CDJR – CDJR saw a notable increase in dealers expecting the franchise to decline in value, from 24% in 2022 to 53% in 2023 – a 29-percentage point increase. Kerrigan Advisors expects this negative dealer sentiment is a reflection of CDJR’s rising inventory levels and lack of incentive spending. Dealers are concerned Stellantis will continue to oversupply the market with new vehicles resulting in a return to pre-pandemic gross profits on new vehicles and a substantial decline in dealer profitability. Consistent with this change, CDJR ranked 2nd behind Ford as the franchise most expected to see a decline in earnings and value as a result of OEM retailing changes, up from 9th place in last year’s survey. Furthermore, 39% of dealers have no trust in CDJR, placing the OEM as the 4th least trusted franchise.

Ford –Ford remains the franchise most expected to see a decline in profits as a result of the OEM’s changes to its retailing model. Consistent with this negative sentiment, Ford is the non-luxury franchise least expected to see a rise in valuation in the next 12 months. These results reflect dealers’ lack of trust in the OEM with Ford ranking as the least trusted franchise – 48% of dealers surveyed reported that they had no trust in Ford, the highest percentage of any franchise. Kerrigan Advisors expects this negative sentiment to impact Ford’s future blue sky multiple and franchise valuation.

Kia – This franchise surpassed Toyota for the first time in 2022 to become the franchise most expected to increase in value over the next 12 months. Impressively, it sustained its improved results in 2023. Notably, Kia saw one of the largest increases in positive profit expectations as a result of expected changes to its retailing model and ranked as the 8th most trusted franchise. These positive results are consistent with Kerrigan Advisors’ upgrade of Kia’s franchise multiple in the second quarter of 2023 and positive outlook for 2024.

Toyota –Toyota continues to outperform on every level. Most notably, Toyota is the most trusted franchise by dealers, scoring 17 percentage points higher than its nearest non-luxury competitor Subaru. This monumental lead in the trust equation has resulted in the franchise having the highest expected increase in profits as a result of the OEM’s retailing changes with only 7% expecting a decline, the second to lowest level behind its sister franchise, Lexus. Most impressive, despite having the highest blue sky multiple of all non-luxury franchises, dealers expect the franchise’s value will continue to rise. These results are consistent with the buyer demand Kerrigan Advisors sees for Toyota franchises.

The 2023 Kerrigan Dealer Survey results demonstrate the changing auto retail environment and dealers’ perspectives of the OEMs. The majority of dealers project profits and valuations will remain at or rise above post-pandemic levels over the next 12 months, though an increasing minority have a more negative outlook. Nearly half of dealers are seeking to acquire dealerships in the next 12 months, despite higher interest rates, an indication of an overall positive industry outlook. That said, dealers have distinctly varying views on specific franchises, with certain OEMs eliciting a lack of trust and confidence, while others earn a high level of trust and strong profit expectations.

Based on these results, Kerrigan Advisors believes there is more risk to valuations and the buy/sell market going into 2024, though we expect transaction activity will remain elevated as dealers seek to add scale to their business and believe OEM retail changes will have minimal impact on future profits.

Methodology

The data for The Kerrigan Dealer Survey was gathered from Kerrigan Advisors’ annual survey of auto dealers in conjunction with the issuance of The Blue Sky Report. The Kerrigan Dealer Survey is based on 650+ anonymous responses from franchised auto dealers in Kerrigan Advisors’ proprietary dealer database. Responses were collected from June 2023 to October 2023.