KEY POINTS

- Incentives are coming back to the auto market, but interest rates remain high.

- However, car shoppers can still reap the benefits. It will require more research and flexibility.

- “Consumers can find good deals, but you have to go model by model,” said Brian Moody, executive editor at Kelley Blue Book.

Incentives are coming back to the auto market, but high interest rates are weakening those deals for car shoppers.

“Pre-pandemic, people would see a 0% financing for 60 months and think, ‘no big deal,’ because it was available everywhere,” said Jessica Caldwell, an insights analyst at Edmunds, an auto research site.

In today’s market, consumers are more likely to see it as “free money,” she said, especially as auto loan rates stay high.

The average annual percentage rate for a new car loan was 7.1% in the first quarter of 2024, marking the fifth month in a row of rates more than 7%, according to Edmunds.

The APR for used car loans rose 11.7% in the same period, up one-tenth of a percentage point from the prior quarter.

Despite high borrowing costs, car shoppers can still reap some benefits from reintroduced financing offers and other incentives like discounts and dealer cash. But shoppers must to do more research than in that earlier era to find those deals, experts say.

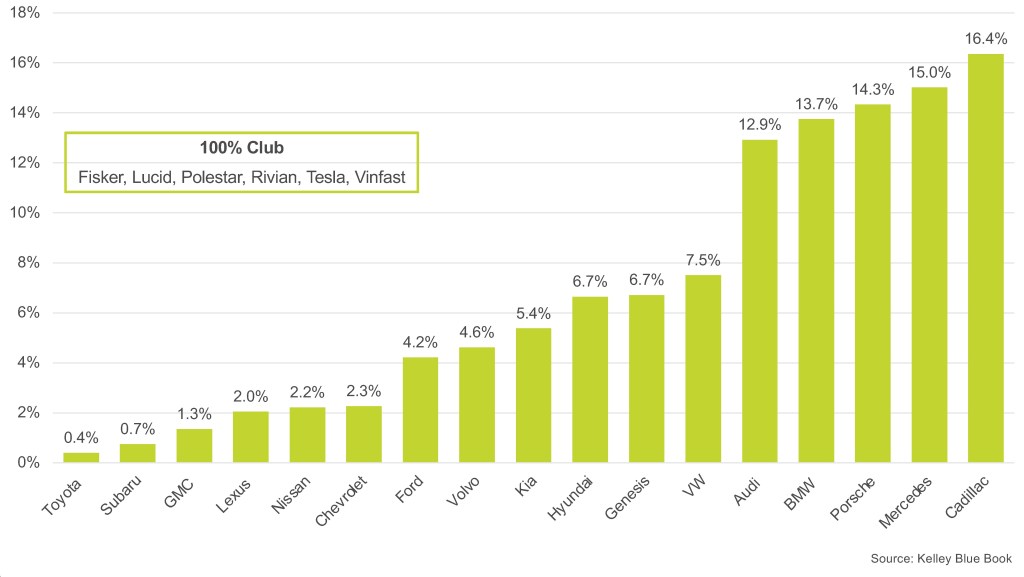

“Consumers can find good deals, but you have to go model by model,” said Brian Moody, executive editor at Kelley Blue Book.

Be cautious about longer loan terms

Financing offers depend in part on the loan term. You might get a better interest rate with a short term, but a lower monthly payment with a long term.

While extending the life of the loan can help shrink monthly costs, you risk owing more than what the car is worth, which can create more financial problems later on, experts say.

“The negative equity situation is real,” Edmunds’ Caldwell said.

Shoppers must be realistic about how long they plan to keep the car, Caldwell explained.

If you’re someone who buys a new car every three to four years, you might end up in a situation when you trade in that your vehicle and is worth less than you owe, she said.

The share of new car purchases in that situation — known as a negative-equity trade-in — rose to 23.1% in the first quarter, according to Edmunds. That’s up from 18.3% from a year ago and 14.7% in the first quarter of 2022.

The average amount of negative equity jumped to an all-time high of $6,167 in the first quarter, researchers found.

When you roll that into your new car loan, it increases your payment.

The average monthly payment for new car shoppers who traded in underwater loans was $887 in the first quarter, according to Edmunds. The average APR was 8.1% for a term length of 75.8 months.

When you’re comparing financing options, instead of only focusing on lowering the monthly payment, be sure to figure out the total interest you will be paying, experts say.

“That’s where you have to be cognizant,” Caldwell said. “Longer loan terms will always look more attractive because they’re more affordable, but that’s really only part of the story.”

According to Moody: “The quicker you pay it off, the less interest you’re paying.”

What to do before you go to the auto dealer

1. Search for available incentives: Car shoppers will have to a do lot more shopping and research to find available incentives, Caldwell said.

“There are deals creeping out there,” she said. “There was a point two years ago where there just wasn’t any; no deals to be had.”

Seek out models that are not in high demand, as automakers and dealers “rarely incentivize popular” models, Moody said.

“There might be cash back or low financing on one type of Ford, but on [another] type, there’s nothing,” Moody said. “It makes it more challenging for consumers because you really have to go and do your research.”

2. Know your credit score: While shoppers might come across 0% financing offers, those deals are often reserved for buyers with excellent credit. Find out what your latest score is to avoid getting stuck into deals you didn’t fully understand, Moody explained.

3. Get pre-qualified for different loans: Shop around for auto loans at different banks or credit unions before going to the dealer, experts say.

That lets you determine what kind of interest rate you’re able to get and compare offers, Moody said.

Don’t limit yourself to comparing the monthly payments. Consider the amount of interest you will be paying over the life of the loan, Caldwell said.

Having these options will also help you negotiate with dealers.

“Always give the dealer the opportunity to beat that deal in terms of interest rate and the loans terms, and oftentimes, they can,” Moody said. “If they can’t, you already have this loan.”

Originally published by CNBC https://www.cnbc.com/2024/05/16/despite-auto-incentives-high-interest-rates-weaken-deals-for-buyers.html?__source=iosappshare%7Ccom.microsoft.Office.Outlook.compose-shareextension