KEY POINTS

- Wholesale prices of used vehicles reached their lowest level in more than a year last month, as retail sales decline amid interest rate hikes, rising new vehicle availability and recessionary fears.

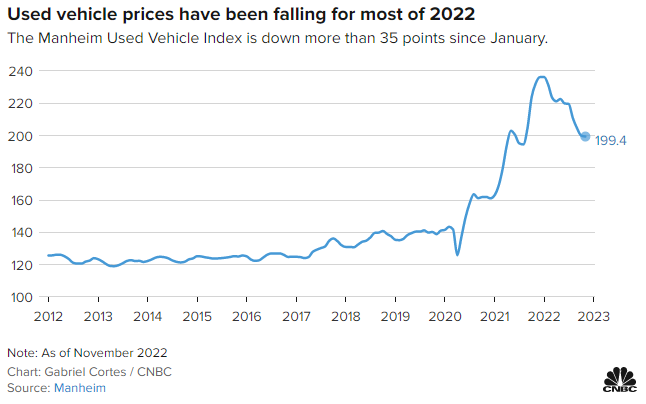

- The Manheim Used Vehicle Value Index, which tracks prices of used vehicles sold at its U.S. wholesale auctions, has declined about 16% from record levels in January.

- The decline is good news for potential car buyers, however not great for companies such as Carvana that purchased vehicles at record highs and are now trying to sell them at a profit.

DETROIT – Wholesale prices of used vehicles reached their lowest level in more than a year last month, as retail sales decline amid interest rate hikes, rising new vehicle availability, and recessionary fears.

Cox Automotive said Wednesday that its Manheim Used Vehicle Value Index, which tracks prices of used vehicles sold at its U.S. wholesale auctions, has declined 15.6% from record levels in January through November. The index dropped to 199.4 last month, below 200 for the first time since August 2021, and is down 14.2% from the same month a year ago. It marks the sixth-consecutive month of declines.

The falling prices come as the availability of new vehicles steadily rises from historic lows, providing additional options for consumers and potentially better loan options from automaker’s financing arms.

“New inventory is finally starting to build, and that’s producing momentum in new retail sales, but that momentum appears to be at the expense of used retail. Especially it’s the traditional used car buyer that’s most impacted by payment affordability,” Cox chief economist Jonathan Smoke said Tuesday during an industry update.

Retail prices for consumers traditionally follow changes in wholesale prices. That’s good news for potential car buyers, however not great for companies such as embattled retailer Carvana that purchased vehicles at record highs and are now trying to sell them at a profit.

Retail pricing thus far has not declined as quickly as wholesale prices, as dealers attempt to hold steady on record-high pricing. According to the most recent data, Cox reports the average listing price of a used vehicle was $27,564 in October, down less than a half percent from the beginning of the year.

“They’re not wanting to sell at trough prices,” said Chris Frey, senior industry insights manager at Cox Automotive, told CNBC last month. “That’s why we’re not seeing the prices decline so much at retail.”

Cox estimates that used retail sales declined 1% in November from October and were down 10% from a year earlier.

Automakers for several years now have been battling through a semiconductor chip shortage that has sporadically halted production of new vehicles, causing record-low inventories of vehicles and higher prices. The circumstances pushed many new-vehicle buyers into the used-car market.

Cox last month estimated the total used market was on pace to finish the year down more than 12% from 40.6 million in 2021.

Originally posted by CNBC.