Electric vehicle (EV) sales growth in the U.S. continues to slow, according to sales data analyzed by Kelley Blue Book. In the first quarter of 2024, Americans bought 268,909 new electric vehicles, according to Kelley Blue Book counts. EV share of total new-vehicle sales in Q1 was 7.3%, a decrease from Q4 2023.

While annual EV sales continue to grow in the U.S. market, the growth rate has slowed notably. Sales in Q1 rose 2.6% year over year, but fell 15.2% compared to Q4 2023. The increase last quarter was well below the previous two years.

In Q1 2023, EV sales volumes were up 46.4% year over year and 15.5% quarter over quarter. In Q1 2022, EV sales were higher by 81.2% year over year and 20.4% higher than the previous quarter.

“Electric vehicle sales in the U.S. declined during Q1 2024 – the first quarter-over-quarter downturn since Q2 2020,” said Stephanie Valdez Streaty, director of Industry Insights at Cox Automotive.

“As anticipated, Tesla’s sales took a hit, influencing the overall market dynamics. However, a few brands saw significant EV sales increases, achieving over 50% year-over-year growth. As noted in January, we are calling 2024, ‘the Year of More’. More new products, more incentives, more inventory, more leasing and more infrastructure will drive EV sales higher this year. Even so, we’ll continue to see ups and downs as the industry moves towards electrification.”

Analysts at Cox Automotive had expected a slowdown in EV sales growth. Segment growth typically slows as volume increases. This is certainly true with the market leader Tesla, which reported notably lower global deliveries in Q1 2024.

According to Kelley Blue Book estimates, Tesla sales in the U.S. were down 13.3% year over year – well below the typical double-digit growth that had become routine with the Tesla brand. Tesla’s share of the electric vehicle market in Q1 2024 was 51.3%, down from 61.7% one year earlier.

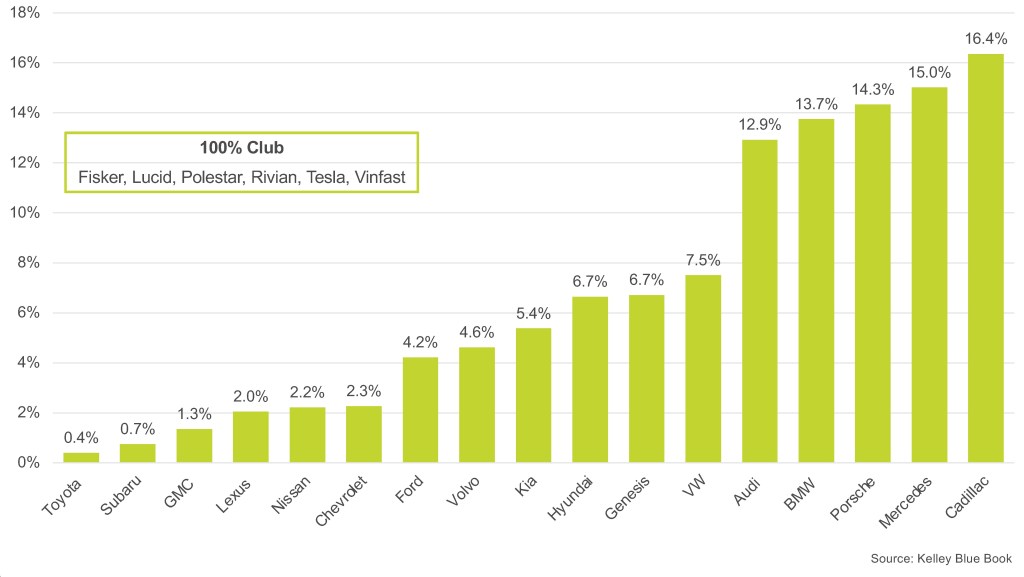

Though the overall year-over-year growth was minimal in Q1, nine manufacturers recorded more than 50% year-over-year growth in EV sales – BMW, Cadillac, Ford, Hyundai, Kia, Lexus, Mercedes, Rivian and Vinfast.

Q1 2024 EV SHARE OF TOTAL BRAND SALES

Notably, lower prices have supported EV sales volume in the U.S., particularly for key Tesla models. The average transaction price for a new EV in Q1 was $55,167, a 9.0% decrease compared to Q1 2023 and down 3.8% quarter over quarter. Tesla’s average transaction price was $52,315 in Q1, down roughly 13.5% year over year. However, lower prices did not generate higher volume.

Many automakers have followed Tesla’s lead and slashed prices. Incentive spending on EVs has increased notably in the past year, another sign of slowing demand. Leasing, too, has increased. In Q1, roughly 27% of all EVs were leased, more than double from the year before. With leasing, many buyers can qualify for the full $7,500 incentive the Inflation Reduction Act offers.

One bright spot in Q1: Strong EV sales from luxury makers, suggesting the EV market continues to be luxury-driven. Cadillac achieved a 499.2% year-over-year increase in electric vehicle sales due to robust sales of its Lyriq model. At Mercedes, EV sales were up 66.9%. BMW posted a 62.6% increase in EV sales compared to Q1 2023. At Audi, Q1 EV sales grew 28.8% year over year.

Meanwhile, sales of the most affordable EV in the U.S. – the Chevy Bolt – have been temporarily halted. Bolt sales fell 64.3% year over year in Q1, hitting just 7,040, as production stopped. A new version of the Bolt is expected to launch in 2025. On the non-luxury side, Ford achieved an 86.1% year-over-year increase in Q1 EV sales with the second-highest EV sales volume behind Tesla.

Cox Automotive forecasts EV sales in the U.S. to increase year over year in 2024, making this year the best year ever for EV sales. Analysts expect EV sales to reach roughly 10% of the market by the end of the year, up from 7.3% in the first quarter.

Originally posted by Cox Automotive- https://www.coxautoinc.com/market-insights/q1-2024-ev-sales/#:~:text=Electric%20vehicle%20(EV)%20sales%20growth,a%20decrease%20from%20Q4%202023