MARK BLAND

Chief sales officer at CarOffer

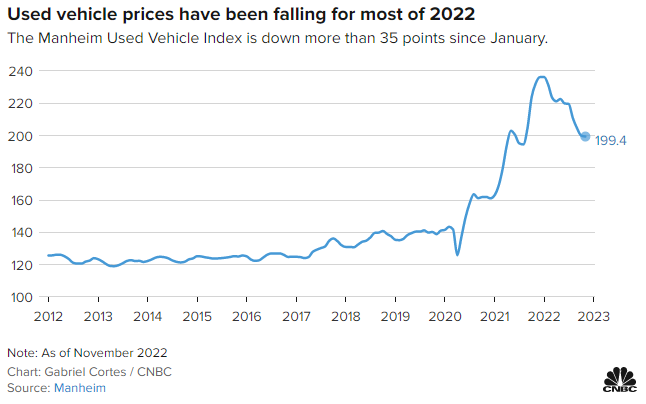

We are in a new era when it comes to dealership inventories, and everyone is searching for a better way to buy and sell vehicles. With rising interest rates and a depreciating pre-owned market, the likes of which we have not seen in a couple of years, late-model vehicles are getting harder to retail.

In this challenging market, dealers have limited options for managing aging inventory. How do you eliminate wholesale losses and manage turn in a declining market?

Here are a few tips I have seen top dealers and dealer groups use to not only get ahead but continue to be successful in the current market.

Trade market disparity

A powerful strategy is to exchange underperforming vehicles in your market for the exact units that you need and will perform at your store. By doing so, you can eliminate wholesale loss and manage turn in a declining market. Sometimes when you want to get rid of a car and get what you need, you cannot always do that at auction.

Far too many dealers fail to consider wholesale this way because the industry has conditioned them to think otherwise. Years of lost profits have led to the opinion that wholesaling is simply a loss dealers have to face. But how about maintaining your retail and wholesale gross profits by trading on market disparity — trading a noncore poorly performing vehicle for a core unit that will perform better?

Market disparity is the price differences that exist from one market to another. You can trade a car you have been unable to retail and is a poor deal in your market to another dealer in a market where it will sell well. In return you get a vehicle you can sell and is a good deal in your market. To be clear here, I am not talking about trading negative equity, but rather trading market disparity.

For a real example, take a Honda Civic. Right now, as I write this, in South Texas that vehicle retails for $8,500 more than it does in Lincoln, Neb. Why not use this to your advantage? Use market disparity search platforms to find dealers with a vehicle that you need and create a one-one exchange using market disparity to decrease the water in each unit and bring in a fresh core car that gets your sales team excited and picking up the phones. You are no longer forced to take that vehicle to the traditional wholesale route and lose a ton of money due to wholesale losses in this particular environment. Not only are you getting rid of stale underwater units, but you are also getting a desired replacement at the same time. This strategy can be a lifesaver for dealers in the current economy, help you gain peace of mind, and mitigate your wholesale losses.

Create a consumer buying center

You may be challenged by the fact that local consumers will not consider selling their vehicle to you if they do not intend to buy a vehicle from you at the same time. They probably do not yet view you as a local buying center for used inventory. They may also have the perception that they can get a better price for their vehicle elsewhere. It is time to change that message and consumer perception. Buying cars from consumers and getting your own inventory channels is the best way to future-proof your dealership right now.

View every vehicle as an opportunity

Many of you may think the best strategy is to source later model cars and stay away from older units that take more reconditioning time and money, aiming to bring the cost per sale down and nudge it in under $15,000 per car. That strategy is not always the best approach.

Brian Moody, the executive editor of Autotrader, was quoted in an Automotive News article (“Why dealers are selling used cars with 150,000 miles and beyond,” May 6) stating, “200,000 miles is the new 100,000 miles for a lot of people. … It’s completely common for something like a Chevrolet Tahoe or a GMC Yukon to have well over 200,000 miles and still sell for a decent amount of money.”

Every vehicle has a value. Some dealers refuse to make an offer if a vehicle is not appropriate for the retail lot. This is a massive mistake. A large percentage of consumers selling also want to buy a replacement vehicle. If the transaction does not immediately result in a vehicle sale for your dealership you have still acquired a valuable inventory unit that will result in either a retail sale or a wholesale transaction. It’s a win in either case and this drives valuable traffic through your doors every day.

Change your mindset to that of your competition —every wholesale vehicle could be a retail vehicle for an independent dealer. Independent dealers find buying trades from franchise stores a desirable thing to do and franchise stores have the credibility and infrastructure to create a highly lucrative consumer acquisition channel. You have the infrastructure and personnel in place to make this happen.

Give customers a fair value on their trade

Nowadays consumers are extremely educated and most know what their vehicles are worth. Some of their estimates are way off. You can get closer to real value and manage consumer expectations with good communication. However, do not try to offer thousands below wholesale values. You will immediately get poor reviews online and on social media and it will not result in your success. Taking advantage of consumers will only result in your downfall.

Don’t be that dealer who feeds into the poor perception many consumers have of car dealers by lowballing your customer trade values. Do not make them feel you are trying to steal their trade while lining your pockets. Be reasonable with your pricing and become the go-to place for consumers looking to maximize their vehicle’s value when they’re ready to sell.

In summary, with current market conditions, it can be tough for a dealer to catch a break, and you may feel as if you are underwater. Talking with dealers who are having remarkable success in this market, I have found that a few simple strategies can make a huge difference.

Article originally published by Automotive News.