Spring has Sprung! This is our favorite time of year and not just because of the great April Fool’s pranks! It is our favorite because the weather changes, the return of baseball , The Masters tournament and it’s the unofficial start of our favorite season of all, Selling Season!

Auto, Powersports and RV dealers all get excited for this time of year as customers get their tax refunds and head to their local dealership to indulge in a new purchase. Although there was a somewhat flat start to the year, optimism continues to build as more and more consumers are acclimating to the new norms of vehicle prices, interest rates, etc.

Our markets have changed drastically over the last few years, and we are finding more and more dealers looking for ways to stay ahead of the curve, maintain COVID level profitability and maximize each transaction with as many products and profit as possible.

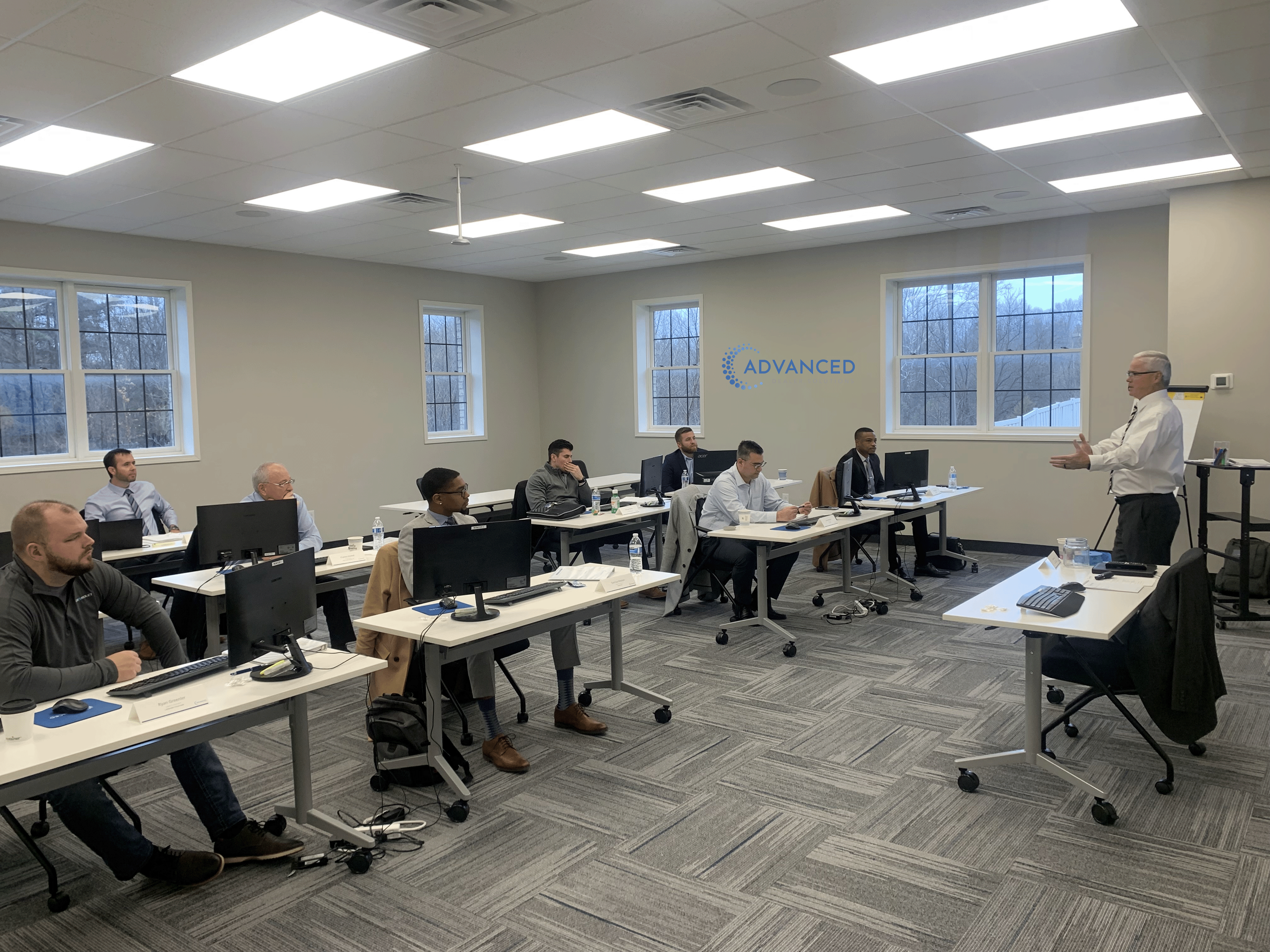

At ADS, we pride ourselves on providing holistic solutions for dealers. Whether it be a dealer looking to mitigate the impending negative equity monsoon (see info and video below), a dealer looking to maximize their marketing and customer data spend (https://clientcommand.com/), a dealer looking to right size their reinsurance position after seeing a spike in loss ratio or a dealer looking to provide their sales staff an extra boost with some training and development solutions (see below for course registration), we at ADS have you covered.

Of course, this in all in addition to our high-performance F&I training and development platform that we have been deploying and perfecting over the past 10-years.

If you are a dealer who wants ‘More in ‘24’, then reach out to us to see if we are potentially a fit for what you are looking for.

To view the full newsletter visit https://mailchi.mp/advdealer.com/april-newsletter-7ms0opj48u